Introduction

Saudi Arabia, a powerhouse in the global oil market, also boasts a dynamic import sector. The country relies on international trade to fulfill its domestic requirements and fuel its industrial growth. This article delves into Saudi Arabia’s import trends, exploring the top 20 most imported products by category to Saudi Arabia, based on data from the United Nations COMTRADE database.

A Nation Reliant on Global Trade

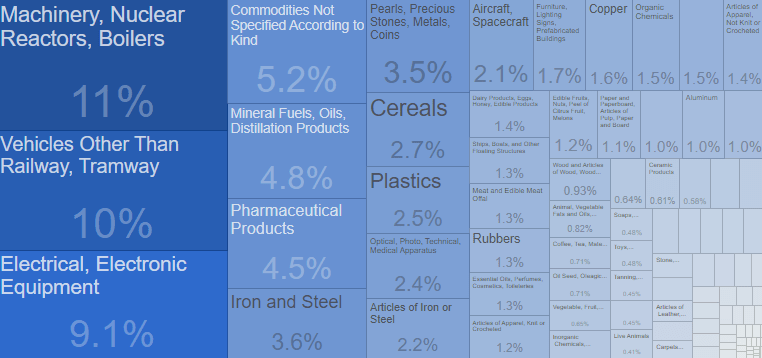

The analysis unveils a fascinating picture of Saudi Arabia’s import trends. Here’s a breakdown of the top categories:

Machinery, Nuclear Reactors, Boilers (11%):

This category, valued at a staggering $16.7 billion, highlights Saudi Arabia’s focus on infrastructure development, power generation, and industrial modernization. From heavy machinery for construction projects to sophisticated equipment for oil refineries, this import segment is a cornerstone of the nation’s economic engine.

Vehicles Other Than Railway, Tramway (10%):

With a value of $15.3 billion, this category reflects the importance of a robust transportation network in Saudi Arabia. It encompasses automobiles for personal and commercial use, trucks for logistics, and specialized vehicles for various industries. This import segment fuels not just daily commutes but also the movement of goods across the vast country.

Electrical, Electronic Equipment (9.1%):

Valued at $13.9 billion, this category underlines Saudi Arabia’s growing reliance on technology. It includes everything from power transformers and industrial control systems to consumer electronics and IT equipment. This import segment plays a crucial role in driving technological advancements and fostering a knowledge-based economy.

Not Specified Commodities (5.2%):

This category, valued at $8.01 billion, represents a diverse range of products that are not readily classified elsewhere. It may include spare parts, specialized machinery components, or even luxury goods. This segment underscores the intricate nature of international trade and the ever-evolving needs of the Saudi Arabian market.

Beyond the Big Three: A Diverse Import Basket

While the top three categories dominate Saudi Arabia’s import trends, other essential products contribute significantly:

Mineral Fuels, Oils, Distillation Products (11%):

This category, valued at $16.7 billion, might seem surprising. However, Saudi Arabia, a major oil producer, imports refined petroleum products and specific fuel types to meet diverse domestic needs. This segment reflects the complex dynamics of the global oil market.

Pharmaceutical Products (4.5%):

Valued at $6.93 billion, this category emphasizes the importance of healthcare in Saudi Arabia. It encompasses a wide range of medicines, medical devices, and pharmaceutical supplies, ensuring the well-being of the country’s population. This Saudi Arabia’s import trends segment highlights the nation’s commitment to public health.

Iron and Steel (3.6%):

Valued at $5.47 billion, this category reflects the importance of construction and manufacturing in Saudi Arabia. Iron and steel are essential components for buildings, infrastructure projects, and industrial machinery. This import segment underpins the growth and development of various sectors inside Saudi Arabia’s import trends.

The Saudi Economy: A Blend of Industry and Consumer Goods

The remaining categories highlighting Saudi Arabia’s import trends on the list represent a mix of industrial necessities and consumer staples:

Pearls, Precious Stones, Metals, Coins (3.5%)

Cereals (2.7%)

Plastics (2.5%)

Optical, Photo, Technical, Medical Apparatus (2.4%)

Articles of Iron or Steel (2.2%)

Aircraft, Spacecraft (2.1%)

Furniture, Lighting Signs, Prefabricated Buildings (1.7%)

Copper (1.6%)

Organic Chemicals (1.5%)

Miscellaneous Chemical Products (1.5%)

Articles of Apparel, Not Knit or Crocheted (1.4%)

Dairy Products, Eggs, Honey, Edible Products (1.4%)

Ships, Boats, and Other Floating Structures (1.3%)

These categories showcase the multifaceted nature of Saudi Arabia’s import sector and Saudi Arabia’s import trends. From raw materials and industrial supplies to finished consumer goods, international trade plays a vital role in sustaining the nation’s economic growth and catering to the needs of its population.

Conclusion

The analysis of Saudi Arabia’s import landscape reveals several key takeaways:

- Diversification Beyond Oil: While oil remains a significant export commodity, Saudi Arabia’s import profile demonstrates a deliberate move towards diversification. The focus on machinery, vehicles, and technology highlights the nation’s commitment to developing its industrial and knowledge-based sectors.

- Strategic Partnerships: The dependence on international trade necessitates strong relationships with global suppliers. Saudi Arabia strategically partners with countries that can provide high-quality products and cutting-edge technology at competitive prices.

- Economic Transformation: The import trends reflect Saudi Arabia’s Vision 2030, a national transformation plan aimed at reducing reliance on oil and fostering a diversified economy. By importing essential goods and equipment, the country fuels its economic growth and creates new opportunities.

Looking Ahead: The Future of Saudi Arabia’s Import Landscape & Saudi Arabia’s Import Trends

As Saudi Arabia continues its economic transformation, its import patterns are likely to evolve. Here are some potential trends:

- Increased Focus on Technology: With growing emphasis on innovation and knowledge-based industries, imports of advanced technology products like artificial intelligence and robotics are expected to rise.

- Sustainability Push: Saudi Arabia’s Vision 2030 prioritizes sustainable development. Imports of clean energy technologies, environmentally friendly materials, and energy-efficient machinery are likely to increase.

- E-commerce Growth: The burgeoning e-commerce sector will likely drive demand for imports of consumer goods directly to consumers. This trend highlights the need for efficient logistics and streamlined customs procedures.

By understanding Saudi Arabia’s Import trends, businesses and investors can gain valuable insights into the future of Saudi Arabia’s import sector. The country’s growing purchasing power and strategic location present a lucrative opportunity for international trade partners.

Are you a company that can cater to Saudi Arabia’s import needs? Explore the possibilities! Verger Group is an ISO 17065 accredited certification body for Saudi Arabia known for the fastest turnaround times in the industry for SCOC and PCOC.

Have a shipment for The Kingdom of Saudi Arabia? Contact VERGER Group today.

Disclaimer Regarding ‘Unveiling Saudi Arabia’s Import Trends in 2025: 20 Most Imported Products’:

All materials herein are the exclusive property of VERGER Group. Unauthorized use is strictly prohibited and may result in liability. Information provided is for general purposes only, not legal advice. VERGER Group disclaims all implied warranties and is not liable for damages arising from use.